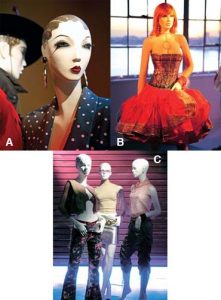

Don't look now, but there's a renewed emphasis on mannequins. You'll see more unique colors, finishes and design elements in stores as retailers strive to make these silent sellers work for them. These trends, as well as a spike in requests for sculpted versions, were highlights in the mannequin showrooms and the tradeshow floor at VM+SD's StoreXpo in New York this past December.

Dwight Critchfield, creative director for Goldsmith LLC (Long Island City, N.Y.), says retailers are looking for an exclusive or personal touch for their mannequins. “I'm seeing far more interest in bold colors,” he says. “High-end retailers are asking for strong colors – red, yellow, turquoise and bright blue – to create a signature piece.”

Tracey Peters, national visual and merchandising manager for Holt Renfrew (Toronto), says a coat of paint is the quickest, easiest way to go when her team needs to change the look of a stylized mannequin quickly. “We often ask for new paint finishes,” she says, “so the mannequins remain unique to us.”

It's not just colors. Retailers are also asking for exclusive positions, according to David Terveen, president of DK Display (New York). “Though many companies are still asking for mannequins with straight arms, that are easy to dress,” he says, “I am seeing a trend toward seated and reclining mannequins, with exaggerated poses.”

Head Games

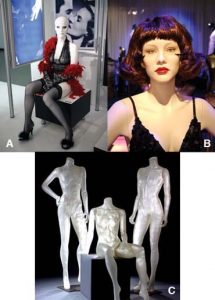

More and more of those bright and posed mannequins also have heads – and not just eggheads or heads from a catalog. “Our customers are starting to want multi-ethnicity to encompass all of their shoppers,” says Stacie White, creative director for Fusion Specialties (Broomfield, Colo.), “something that's unique enough to become an identifiable brand icon.”

Richard Rollison, executive vp at (New York), is also redirecting his company's efforts toward sculpted and abstract mannequins. “Mannequins with heads create more drama and presence for retailers,” he says. “Branding has become so important to customers like Federated, Tommy Hilfiger and Liz Claiborne. They want mannequins that are designed to feel like their brands.”

Sculpted Lines, Rising

The good news for the mannequin industry is that many retailers are beefing up the use of mannequins storewide. “We're focusing on the product, first and foremost,” says Jonathan Lander, vp of visual merchandising for Foley's (the new Houston-based Federated acquisition), “and mannequins are the best way to accomplish that.”

Holt Renfrew's Peters adds, “We're using more mannequins than we have in the past decade, because we feel they are beautiful options that make very strong statements for us.”

Ignaz Gorischek, vp, visual planning and presentation for Neiman Marcus, uses realistic mannequins very selectively, mainly in store windows and on feature platforms in key traffic areas. “The attention and detail that goes into styling a realistic mannequin is critical to its success. There's nothing worse than a poorly styled mannequin.”

Peters says Holt Renfrew uses realistic mannequins once or twice a year for themed luxury windows, such as holiday. “Adel Rootstein USA Inc.'s realistic mannequins are the best for capturing the look and feel of a real person,” she says. “But otherwise, we use stylized and abstract mannequins to create fantasy and whimsy in our displays.”

Lander says he uses realistic mannequins minimally because his stores aren't equipped to deal with the makeup and wigs. Instead, he uses a variety of abstract, sculpted, semi-realistic and headless mannequins.

Critchfield feels requests for customization have led to a big interest in sculpted heads on mannequins. “Retailers need to have the staff and know-how to handle realistic mannequins or else they require too much attention,” he says. “That's why sculpted mannequins are becoming so popular. Also, they have a fresh and modern appeal.”

Getting Younger

As the youth market continues to flourish, many companies introduced new lines at StoreXpo to reflect this trend. “Go to any fashion show, and you'll see that designers are catering to girls 16-20,” says George Martin, vp, creative director at Patina-V (City of Industry, Calif.). “This group has expendable money and tremendous buying power.”

So what does this mean to retailers? Not only is Generation Y the largest group of young people since the 60s – when baby boomer teens began their assault on society – but they spend upwards of $170 billion a year, whether it's from their own pockets or their parents. Simply put, this group needs to be addressed.

Charles Machen, sales director of RHO Inc. (Anjou, Que.), says his company is reacting to this thriving, younger market segment. Hans Boodt Mannequins, RHÔ's Dutch partner, introduced the “Scandalous” line of mannequins with sculpted hair and makeup. “We decided to put the focus on the face rather than the hair,” he says. “The mannequins' facial expressions convey an attitude, and their makeup is quite dramatic.”

Italian mannequin manufacturer (Mariano Comense, Italy) introduced its own young mannequin line, called “Teen,” featuring current hair and makeup styles. According to Almax, “The youth market is a very important segment of the fashion industry, and retailers want mannequins to support their teen and children's wear.”

Ethnicity and Curves

As the average woman's size has increased over the years, the mannequin industry has created more realistic sizing. Fusion's White explains that her company's sculpting and custom work is heavily demographic-inspired. “Retailers are looking at their customers' body types and requesting mannequins that are true to size,” she says. “We're in the phase of creating curvy, athletic figures.”

RHÔ's Machen says his company anticipated the trend too early. “We developed the Ordinary People collection a few years back, which features casts of real bodies in more forgiving sizes,” he says. “Retailers liked the line, but we didn't sell many. In the latter half of 2005, though, we've seen a complete turn-around in terms of requests for realistic-sized mannequins.”

The company is now going back and modifying the collection to reflect today's customer base.

In addition to diversity in size, retailers are emphasizing ethnically diverse models. “We've seen a trend toward more ethnic-specific mannequins,” says Barry Rosenberg, principal of Mondo Mannequins (Hicksville, N.Y.), “particularly Hispanic mannequins, due to the population surge in this group.”

Patina-V has also had more requests for mannequins representing the Hispanic population. “This group has amazing buying power,” says Martin. “Our customers like to have a mix of ethnicities in their stores to represent the world's diversity.”

Fighting Against Shrinkage

Mannequin makers not only have to keep up with the latest trends in styling and color – they're also having to confront issues such as mannequin theft and increasing competition from Chinese manufacturers.

An example of the theft problem: Foley's Lander is in the process of spending a substantial amount of money to replace mannequin hands that have walked out the door with mischievous children or teens. “I keep hammering on my manufacturers to make the hands integral to the arm or at least difficult to get off,” he says.

To address this problem, companies like RHÔ are experimenting with magnetic arm and waist fittings. Making the hands integral to the arms lessens the chance of someone leaving the store with certain body parts in tow, Machen says.

Retailers would also like unbreakable mannequins. And some manufacturers are delivering. “Our Unbreakable series uses polystyrene instead of fiberglass to eliminate chipping, hairline fractures and other routine damage,” says Mondo's Rosenberg. “These mannequins are especially low-maintenance for those retailers with limited visual merchandising budgets.”

The Chinese are Coming

Almost every mannequin company expressed concern over competition from the Chinese, who are delivering mannequins at low prices. Says Foley's Lander, “I hate to see production going out of the country, but the Chinese are learning to create a good product at a competitive price. Retail's dollars are stretched, so we need to make the most of our money. American manufacturers need to realize this and come up with something innovative at a good price.”

RHÔ, for one, has traveled to Asia and secured factories to produce the mannequins – but only if necessary and, more important, with conditions. “Most manufacturers are using Asian-based production factories, so we had to be realistic and explore our options,” says Machen. “If we use a Chinese factory to produce our mannequins, they must use our molds and materials. We won't sacrifice quality for a lower price.”

Photo Gallery2 days ago

Photo Gallery2 days ago

Headlines1 week ago

Headlines1 week ago

Headlines2 weeks ago

Headlines2 weeks ago

Sector Spotlight2 weeks ago

Sector Spotlight2 weeks ago

Headlines1 week ago

Headlines1 week ago

Headlines4 days ago

Headlines4 days ago

Headlines2 weeks ago

Headlines2 weeks ago

Designer Dozen1 week ago

Designer Dozen1 week ago