“Made in China.” Thre was a time when those words scared retail fixture buyers.

But this year, Limited Brands will spend 18 percent of its total dollars for store design and construction on sourcing goods in Asia – four times more than last year. Why?

“Overseas fixture manufacturers have raised the standard of what they can offer and the inherent quality,” says Bob Waddell, vp, purchasing for Limited Brands Store Design & Construction (Columbus, Ohio).

It has been a four-year learning experience for Limited. In early 2001, the retailer saw more and more North American fixture manufacturers forming strategic alliances with Asian facilities. So Waddell made an exploratory trip to southeast Asia to look at manufacturing facilities in Singapore, Malaysia, Vietnam, Taiwan and mainland China.

What he saw were surprisingly modern facilities and quality goods. Limited began working in China through North American fixture manufacturing partners. By 2003, the retailer was sourcing most of its metal hardware for its more than 4000 stores from Taiwan and mainland China, while more of its furniture and wood fixtures were also beginning to come from Asia.

Retailers and fixture manufacturers have been going overseas for fixture components and brackets (mostly metal) for a long time. But the big news today is that they are sourcing complete fixtures. And more fixture manufacturers are working with overseas factories, too.

Reeve Store Equipment Co. (Pico Rivera, Calif.) began sourcing more than just display hardware in the 1990s at the urging of one of its biggest customers, a department store chain interested in purchasing all of its metal fixtures from one supplier. But the retailer told Reeve it didn't want to pay U.S. prices for goods it knew could be found for less overseas.

“We told them we didn't do that much importing,” says vp Robert Reeve Frackelton. “And they said no, but you will do it. So it was really a customer that forced us to get into it full charge.”

Today, Reeve has a working partnership with a factory in Taiwan and two in mainland China. “On one hand, I'm an American manufacturer and I really want to produce as much as I can in America,” says Frackelton. “But I'm also a realist, and I know that my customers aren't willing to pay for American-made store fixtures all the time. So we've got to play the game.”

According to this year's VM+SD Top 50 Fixture Manufacturers survey, 69 percent of responding fixture companies said that their business is being impacted by retailers turning to foreign sources of fixtures.

“China is not just about cheap labor,” says Klein Merriman, executive director of the National Association of Store Fixture Manufacturers (Hollywood, Fla.), which embarked on its first trade mission to China with its members this month. “China has developed more technology and has become a much more effective global competitor.”

The Fixture Game

As was the case with Reeve Store Equipment, pressure from retailers has been forcing many manufacturers to look for ways to produce less-expensive goods. Fixture companies began sourcing more finished goods overseas – typically high-volume, stock items such as chrome 4-way racks. Problems were abundant, however: poor quality, ill-fitting components and late deliveries. And that nullified many of the savings.

But more recently, quality problems have been disappearing. Facilities in China are modern and high-tech (and labor is abundant and cheap there and the costs of doing business are low). Better equipment has led to the improvement in quality and the ability to produce more than just stock components.

And inherent issues, such as design compatibility and on-time delivery, seem to have been worked out. Today, in fact, China's fixturing market is also producing custom metal and wood fixtures, a capability that didn't exist five years ago.

All other things being equal, it's not surprising that the move to export fixtures from abroad has come down to cost. “For what it would cost me to produce one basic chrome 4-way rack in the U.S., I can bring in four or five from overseas,” says Frackelton.

Those savings are so compelling that manufacturers and retailers have been willing to work through communications barriers, complex freight logistics and other existing issues until better systems are in place.

“Every retailer has pressure to be more efficient in terms of cost reduction for fixturing and construction,” says Limited's Waddell. “Especially mature retailers that are doing a lot of retrofit or renovations, which involves a lot of fixturing.”

As a result, many fixture manufacturers have realized that to stay competitive and meet retailers' demands, they need to look overseas.

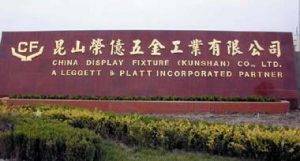

Dann Dee Display Fixtures (Niles, Ill.), which was acquired in 1999 by Leggett & Platt Inc., has been working overseas for 18 years. It began by partnering with a factory in Taiwan and educating the Chinese on what it needed to serve the retail market. As technologies improved, and Internet communications allowed immediate discussion of problems or transmission of designs, the company's import business took off. By the late 1990s, Leggett had partnered with two additional plants in China, giving it a total of 1,100,000 square feet of controlled manufacturing space.

Today, says Larry Chronowski, Dann Dee's vp, purchasing and imports, “We're starting to deal with a lot of upper-scale department stores through our Asian partners because we can now offer the quality and finishes from our overseas facilities that retailers are looking for.”

Room for Improvement

Despite the improvements in overseas sourcing, limitations still exist. Many manufacturers say considerations such as type of job and lead times influence whether fixtures are produced overseas or at North American facilities.

“If a retailer is looking for a one-time rollout of 500 racks, we're probably better off producing it here than going overseas,” says Frackelton. “If they are looking at doing 500 racks a quarter, then it behooves us to make it over in our China plant.”

That said, many manufacturers say that the high-end, custom fixture market for specialty retailers will remain in North America because the smaller volumes are not cost-effective to produce and ship from overseas, and the high craftsmanship remains a specialty.

While most of the work coming from overseas has heretofore been metal, many retailers and manufacturers are beginning to source wood fixtures from China, as well. However, they are proceeding with caution as they sort through issues such as laminates and materials control.

“We're starting to get into it and see how it develops,” says Dann Dee's Chronowski. “One of the big problems is matching up a retailer's laminate with an overseas one.”

Shipping is also a bigger issue with wood fixturing, because of the amount of container space such fixtures take up. Therefore, partially finished or knocked down wood fixtures are typically shipped from overseas and assembled or completed in North America, taking up less freight space and allowing more to be shipped in each container. And to deal with lead times, some companies offer blended programs, whereby a rollout program is started with fixtures manufactured in North America, and then completed with goods produced and shipped from overseas.

Eye on the Future

While China is currently enjoying a strong economy and a large, cheap labor force, making it increasingly the place to be today for overseas fixture sourcing, observers agree that the overseas market could again relocate – to, say, India, Mexico or Africa – if the right changes were to take place.

“Other foreign companies are making inroads here,” says Steven Keith Platt, managing director, S.K. Platt & Co. Merchant Bankers (Hinsdale, Ill.). “But right now, it's China that has the low labor costs.”

Retailers are telling North American fixture manufacturers that overseas competition does not spell the end for their businesses, but that they need to be aware of the Chinese market and consider establishing relationships with factories overseas.

“Those in the metal world have had to expand into a blend of U.S. and overseas manufacturing services for some time now in order to succeed,” says Frackelton. “Now the wood world needs to wake up because the same thing is going to happen there. You'll be out of the game if you don't jump into it.”

Photo Gallery1 week ago

Photo Gallery1 week ago

Headlines4 days ago

Headlines4 days ago

Headlines1 week ago

Headlines1 week ago

Headlines2 weeks ago

Headlines2 weeks ago

Headlines1 week ago

Headlines1 week ago

Designer Dozen1 week ago

Designer Dozen1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago